Before I answer your question, let me ask you something.

What are Bitcoins?

If you don’t know the answer, read on, since understanding

the blockchain is only possible with an example.

Bitcoin

Bitcoin is a decentralized cryptocurrency, which is exchanged

over a peer-to-peer network. When people speak about “bitcoin”,

they mean the network which supports bitcoin or the cryptocurrency

exchanged on the bitcoin network.

It is a cryptocurrency because it uses cryptographic techniques to

prevent fraud and counterfeiting. The bitcoin network is said to be a decentralized one because:

- No single person/organization controls the production or exchange of bitcoins.

- The bitcoin network is a peer-to-peer network.

- The database/ledger storing the records is present in each node on the network.

When referring to bitcoins as a cryptocurrency, people usually

mean that the currency is in the form of digital tokens.

These digital tokens may be stored in special physical devices

or programs called cryptocurrency wallets. On a computer, these

tokens are stored as files, but have some special properties.

The purpose of any cryptocurrency (or any currency for that matter)

is to serve as a medium of exchange. Bitcoins can be exchanged for

electronic goods or services. Just like bank notes can be exchanged

for fruits and vegetables. If you aren’t satisfied with bitcoins as

a medium of exchange, let me give an example.

An example

Let’s assume that you had a very hectic day at your school/college/workplace

On your way home, you see a shop selling ice-cream and you feel a sudden,

urge to have a sweet, cold dollop of that delicious stuff.

You have enough money to buy it, so you stop by. After exchanging

the required money, you finally get to enjoy the ice-cream.

From the above example, you may realize that money was used to buy an

ice cream. But in reality, all you did was exchange an item for another

item (in this case, money for an ice-cream).

In an alternate scenario, if you didn’t have enough money, you could

have exchanged something of equal value, such as a wristwatch for that

ice-cream. This type of exchange was in use a long time ago, and is

called the barter system, wherein goods are exchanged directly.

Double Spending

Let’s take a 21st century scenario into consideration, albeit the same one.

Assume that you still need an ice-cream, but the shop is an online

marketplace. In such a case, you can be reasonably sure that your

money will reach the merchant/shopkeeper using existing ways of sending

money using the internet. Your merchant’s identity can be verified

using digital signatures, and the merchant can do the same for you.

However, there is no mechanism in place to prevent someone else,

or even you, from spending the same digital money/currency/token

for some other product or service, say a bowl of noodles.

This is called the double-spending problem.

One way to solve this problem would be to store your money with a

third party, such as a friend or even better, a bank. The bank or

the friend needs to be trusted by both people participating in the

exchange. Now in the modern scenario, your money may be stored

in an account with the bank, and the shopkeeper may have his/her

own account. After you request money to be transferred to the shopkeeper,

your bank transfers that money on your behalf to the merchant’s bank.

Authentication and security of this process is the bank’s responsibility.

Problem solved. Or has it?

The bane of centralization

Your friend can be quite a trustworthy person, but the same may not

hold for a bank. The problem with banks being an intermediary to

online payments is that the security of the entire transaction

rests on the bank’s shoulders. If your friend, who is a mediator

between you and the merchant is threatened by someone to give your money,

he/she may do so. In case of a bank in the role of a mediator, these threats

occur in the form of bad decisions and cyber attacks. Another issue

is that for international money transfers, a significant transaction fee is

charged by the bank. If you search deeper, additional issues crop up

which often don’t have practical solutions. These include reversible nature of

fund transfers, freezing of bank accounts by nation states, etc.

Some historical perspective

Over the past 30 years, various cryptocurrencies were invented

to facilitate trade over the internet. Some of them, such as ecash

and b-money inspired cryptocurrencies like bitcoin.

Most early currencies were unable to solve the double spending problem

in a satisfactory way. Some, such as DigiCash could solve

this problem, but failed due to other reasons.

Bitcoin, using the blockchain was the first cryptocurrency to solve

a lot of existing problems with digital currencies, which has

undoubtedly led to its success among its peers.

The Answer

Bitcoin and other cryptocurrencies owe their success to the underlying

blockchain technology. Blockchain is a technology which enables

people/organizations to create permanent and immutable records in a

distributed way over a trust-less network. These records can store transaction

information, land titles or even vehicle registration details.

Every node participating in the network has knowledge of the state

of the network, and so has a copy of the distributed ledger/database.

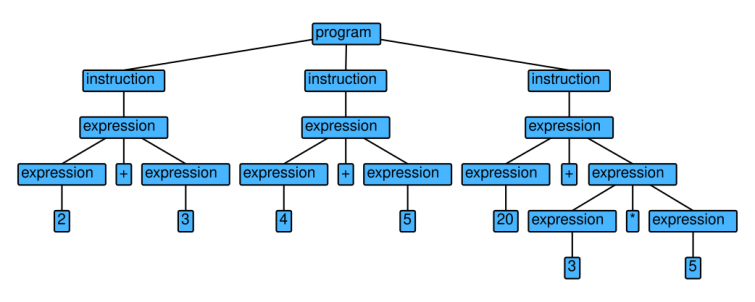

Whenever a transaction occurs (or a new record is added), it is broadcast

to all the other nodes on the network. As soon as the other nodes

know about the transaction/record, they include it in

a data structure called a “block”. Each node works to solve a

computationally difficult puzzle as the proof of work. This is

required to prevent fraudulent records being inserted into the network.

Moreover, this mechanism (in literal terms: proof that you have worked)

deters denial of service, spam and other interruptions.

Blocks are added to the network at a specified rate. When a node finds the

solution to the puzzle, it broadcasts the solution to all other nodes.

The remaining nodes accept a block only after verfiying the records in the block.

If the block is accepted, the nodes start working on the next block, using

some special data from the previous block. This special data ensures that

malicious actors cannot change the records in previous blocks, because to do so,

all the computational problems must be re-solved, which is a mammoth task.

Since newer blocks are related to the previous ones in a specific way, this set of

blocks forms a blockchain.

Enfin

Many other services can be implemented on the blockchain. For example, NameCoin is

a service created to improve the decentralized nature of the internet.

Another interesting example is Ujo Music, which is an Ethereum (another cryptocurrency)based platform for artists to directly sell their music/merchandise.

Hopefully, you now have a basic idea of how blockchains work.

For a detailed tour of the innards of blockchain technology, stay tuned.

6 thoughts on “What is the Blockchain?”