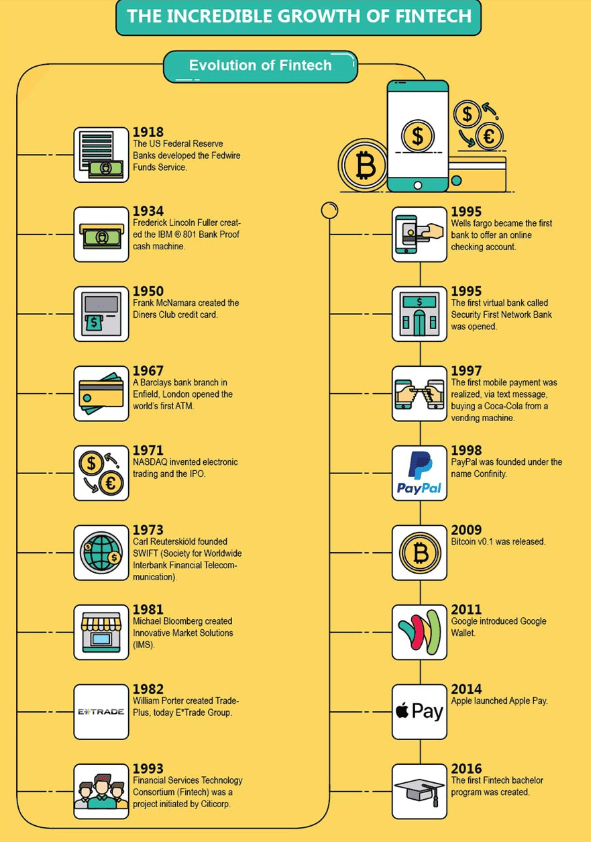

There has been a growth in the technological era. It is transforming the perspective towards the traditional ways of approach. One such technology that changed the custom banking system is FinTech. Let’s dive into the details how FinTech brought the modulations in the financial graphs.

FinTech is any organization that toils to provide financial services to its customers in an efficient path with the use of technology. It relates mainly to minor start-up companies, which advance innovative technological solutions in such areas as online and mobile payments, big data, alternative finance, and financial management. It is making the world go digital in finance where your money can be exchanged online, stock markets at the fingertip, and investments with direct interaction.

A good overview of Fintech with a B2C focus, including market size, business models, consumer views, blockchain technology, and company profiles can be found in the Statista Report 2019. In 2018, almost 70 percent of senior banking executives said that teaming up with Fintechs and Bigtechs to create a new service was a significant opportunity for banks.

In 2019, approximately 2700 FinTech deals were confirmed. Regardless of the increased number of deals compared to 2019, the total value of investments was less than the 2018 record of $141 billion.

Small Businesses:

Fintech has been a key game-changer for entrepreneurs, making it easier for startups and minor businesses to secure loans, manage the workforce, and process payments. PayPal has made secure transactions online and allowing small businesses to avoid the transaction fee from the banks. The immanent risks from payment platforms are mitigated with the use of AI and Machine learning models by analyzing the risks. Fintech has facilitated small businesses, that were seen as higher risks initially.

Global fintech melds hit a record high of $97.3 billion in 2019, while $3.5 billion was invested in deals by international tech titans such as Alibaba, IBM, Alphabet, Microsoft, Apple, and Tencent, marking an increase in deals for the fifth year in a row.

Business Alliances

The competition looked to be foreseeable between the traditional financial intermediaries and the new generation of fintech companies and indeed the struggle for market shares often leads them to clash with each other. However, in recent times, conventional banks and fintech startups have also been looking forward to collaborating with each other to bring the services to the customer that are more convenient. MasterCard is a project to provide backing for the entrepreneurs to start their projects in domains like banking, AI, security, and logistics by giving them access to the MasterCard ecosystem. Traditional banks are now looking for collaboration with the already established FinTech companies to offer customers more optimized experience and security in Financial transactions instead of reinventing FinTech.

Chatbots:

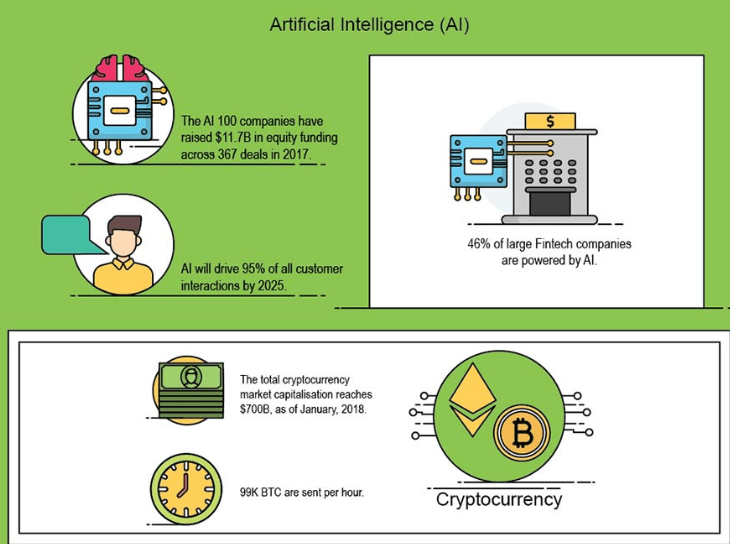

Fintech is also an intense adaptor of automated customer service technology, utilizing chatbots and AI interfaces to support customers with their basic queries and also keep down staffing costs. They work based on the dynamic algorithms that renovate themselves according to the issues resolved in the past. Fintech is also being anchored to fight fraud by grasping the information about payment history to flag transactions that are outside the norm.

Cillian Leonowicz, co-lead of the Deloitte EMEA blockchain lab, said that one of the biggest myths is that fintech players will substitute banks overall. “Typically, fintech (but not in all cases) attacks only a small portion of a value chain (or niche customer segment) where it can make an impact and create sustainable revenue streams,” he said.

The most common reason for not using fintech payment solutions is concern over security standards. Digital payment-processing companies essentially have to invest in patching up security holes and show consumers that the suitability of their services balances everything else. Implementing this would certainly help in the growth of their markets.

FinTech is active in domains such as cryptocurrency (digital currency such as bitcoin), Smart contracts (automatically executing contracts between buyers and sellers), Robotic advisors that automatically advise the investors to lower their cost and accessibility, etc.

FinTech companies can create a more diverse and stable credit landscape by gathering data from social media and other sources to assess the needs of young businesses and borrowers on the borders of the banking system. A strategic planning process and framework that illustrates how it starts with the enterprise environment and subsequently collecting and analysing all information about the context and company to formulate their strategies.

Conclusion:

FinTech is expanding its impact and marking its presence in the digital world exponentially. Its time we adopt to the contemporary way of businesses. Understanding the necessity of security and automation in FinTech, if the companies can patch the vulnerabilities there would be an ample growth in the graph of FinTech practice.